Fintech Update, 5/24 - 6/6

Hi! It’s Monday, June 7, 2021.

Hey, everyone! We’re happy to be back in your inbox after a week off. Buckle up for a two week mega-update! 🚀

Leading Off

Ally announced that it will no longer charge overdraft fees, following positive customer feedback after waiving the fee early in the pandemic. // In other news, the President of El Salvador announced plans to send proposed legislation to the country's congress that would make the cryptocurrency legal tender in the Central American nation; according to unveiled code, Square is planning to launch checking and savings accounts; and Visa expanded its partner program that allows financial institutions to connect with a curated set of technology providers. // Plus, Acorns is going public via SPAC, Klarna made A$AP Rocky its CEO for a day, and we struggled (yet again) to keep up with all of the funding headlines. // All this + more below!

Heavy Hitters

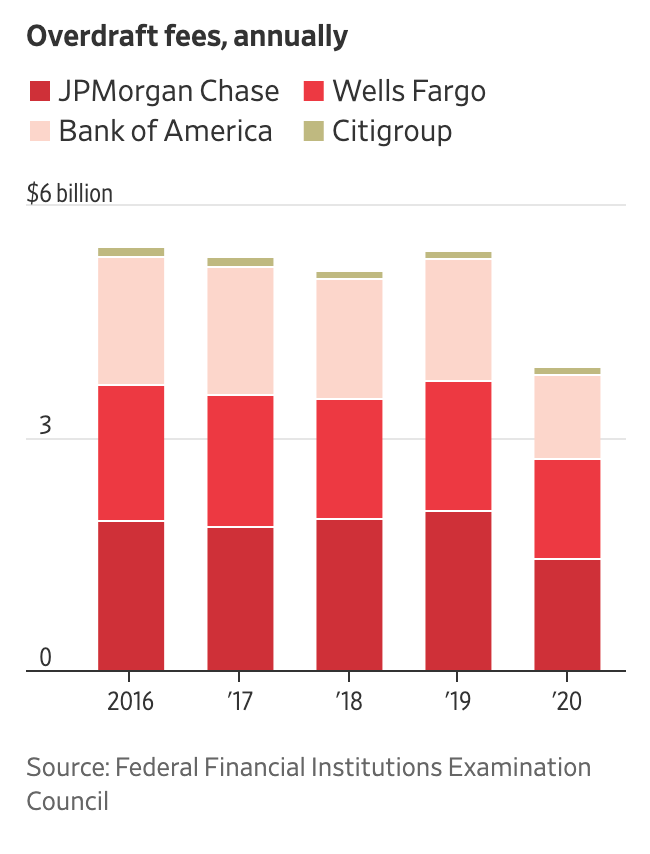

Ally does away with overdraft fees. Ally announced that they are getting rid of overdraft fees, after receiving very positive feedback when it temporarily suspended the charges in the early months of COVID-19. Prior to this change, Ally used to charge customers who overdrew their checking accounts a $25 fee. Many big banks were lenient on overdraft fees at the start of the pandemic but have since reinstated. Ally’s decision to permanently nix the overdraft fees is a significant one but what we will be keeping a close eye on is how the industry responds. If Ally remains the only big bank to do so, not much will change as Ally’s decision will only apply “to the roughly 3.6 million checking, savings and money-market accounts at Ally’s online bank.” However, this decision from Ally, along with increasing pressure and growth from up and coming challenger banks who also don’t charge overdraft fees, could serve as the first domino to fall in eliminating these fees across the industry which have historically proven to be particularly burdensome and impactful to black households and those with low-to-moderate incomes, as they “are almost twice as likely to incur overdraft fees as white households or those with higher incomes.”

Quick Takes

El Salvador may formally adopt BTC as legal tender. In a pre-recorded message to the attendees of last week’s Bitcoin conference in Miami, President Nayib Bukele said he will “send to Congress a bill that will make Bitcoin a legal tender in El Salvador . . . [to] help provide financial inclusion to thousands outside the formal economy,” If the bill is passed, BTC would join the US Dollar as El Salvador’s legal currency.

Square launches checking and savings accounts. According to some uncovered code, Square is planning to launch checking and savings accounts (Square Checking & Square Savings) later this year after being approved for a U.S. banking charter in March. Based on the code, “Square is planning to offer a 0.5% interest rate for its savings account.”

Visa builds online marketplace for fintechs. The global payments processor announced that it’s expanding its Visa Fintech Partner Connect Program, which allows financial institutions to connect with a set of preferred technology providers. Visa hopes to place itself in the middle of these relationships to drive spending on its payment rails.

EU set to unveil digital wallet program. The European Union will reveal detailed plans for a bloc-wide digital wallet this week. The app will securely store payment details and official documents like driver’s licenses, and allow citizens across all 27 countries to log into government sites and pay utility bills using a single recognized identity.

Pop Flies

Cybersecurity firm NortonLifeLock will let users mine ethereum on their personal computers.

Apple Card had an outage this week.

Savings and investment app Acorns announced that it is going public via SPAC at a $2.2 billion valuation.

Swedish BNPL provider Klarna is closing in on a new funding round led by Softbank at a valuation of over $40 billion…

...and promoted A$AP Rocky to CEO for the day.

Australian BNPL provider Afterpay announced that it will debut a new feature: “see now, buy now” at this year’s New York Fashion Week.

Diem’s chief economist conceded that the original plan for Libra was “naive.”

Fundings!

Wealth management

Personal finance startup Truebill raised $45 million in Series D funding, led by Accel, only months after raising a $17 million Series C.

Alternative investment platform Yieldstreet brought in $100 million in Series C funding at a “near unicorn” valuation.

Lending

Home buying-focused fintech Homeward raised $136 million in Series B funding and secured $235 million in debt.

Resolve, the B2B-focused spinout of BNPL giant Affirm, raised $60 million in a combination of equity and asset funding.

Colombio-Brazillian BNPL firm ADDI raised $35 million in Series B equity led by Union Square Ventures, plus an additional $30 million debt facility to fund additional lending.

Auto loan refinancing platform MotoRefi raised $45 million in new funding, led by Goldman Sachs, only months after raising an initial $10 million.

Mumbai-based Jai Kisan raised $30 million to expand its financing and BNPL products to millions of unbanked Indians living in rural areas.

Non-dilutive capital provider Capchase raised $125 million in a Series A funding round led by QED investors.

Banking

Banking tech provider Zeta raised $250 million in a Series C funding round led by SoftBank Vision Fund 2.

British financial services platform Curve raised nearly £10 million in equity crowdfunding via Crowdcube, the service’s “largest ever equity raise.”

“Fintech as a service” platform Synctera, which connects fintech firms with partner banks via APIs, raised $33 million in Series A funding led by Fin VC.

Payments

Fraud solution provider Forter raised $300 million in a Series F funding round led by Tiger Global at a $3 billion valuation.

UK payments platform PaySend raised $125 million in Series B funding at a $700 million valuation.

African payment service provider OPay is reportedly in talks to raise $400 million in new funding at a $1.5 billion valuation.

African cross border payment provider Chipper Cash raised $100 million in Series C funding.

Crypto

Talos, the company that provides technology that allows financial institutions to support digital asset trading, raised $40 million in a Series A funding round led by a16z, with participation from PayPal Ventures and Fidelity Investments.

Crypto platform Circle raised $440 million in a funding round which included participation from Fidelity Investments.

Corporate

Clara, the Latin American corporate card provider, raised $30 million in new funding and secured a $50 million revolving debt facility at a $130 million valuation.

Infrastructure

Nigerian open finance company Mono raised $2 million in seed funding.

Dutch fraud detection system provider Fraudio raised $3.3 million in seed funding.

Payroll API provider Pinwheel raised $20 million in a Series A funding round led by Coatue.

Latin American open finance API platform provider Belvo raised $43 million in Series A funding.

Ecuadorian financial infrastructure provider Kushki raised $86 million in a Series B funding round at a $600 million valuation.

Digital identity platform Socure secured a strategic investment from Capital One Ventures.

Insurtech

Insurtech platform Trellis raised $10 million in a Series A funding round led by QED investors.