Fintech Update, 2/5 - 2/11

Hi! It’s Monday, February 12th, 2024

The Rundown

Last week's earnings announcements highlighted the importance of managing investor expectations, with mixed results across two payments giants:

While PayPal beat Q4 earnings per share expectations ($1.48 vs. $1.36), public investors were underwhelmed by the company's lower-than-expected guidance for 2024, leading to a 9% decline in share prices last Thursday. To soften the blow, CEO Alex Chriss stressed profitability and margin expansion on the post-earnings call, referring to 2024 as a “transition year” for the payments firm. The earnings announcement comes several weeks after PayPal announced the rollout of several new features at its Innovation Day which, by most accounts, didn’t “shock the world” as CEO Alex Chriss had promised. [See our coverage of PayPal’s Innovation Day fumble from several weeks ago].

Having previously revised growth forecasts downward in Q3 to avoid any surprises heading into 2024, Adyen shares surged over 21% on the heels of higher-than-expected 2023 profits and strong revenue growth (€1.63B 2023 net revenue, up 22% year-over-year). Adyen claimed that its performance was driven by “continued growth across [its] existing customer base consistent with…underlying land-and-expand fundamentals.”

Data security provider Entrust announced plans to acquire facial recognition and identity verification provider Onfido. Though sources claim the acquisition price is “well above” $400M, terms were not disclosed alongside the announcement. The news underscores the ongoing trend towards consolidation of independent point solutions across the identity stack. According to Entrust CEO Todd Wilkinson, “it’s a confusing market for a lot of end users, because there’s a lot of players in the space…it’s also difficult from an end user’s perspective. What we’ve seen in the last year-plus is, frankly, for companies like ours that have stable financial platforms, we’ve had the opportunity to actually thrive.”

Core banking provider FIS announced the launch of its interoperable “Open Access” platform to allow customers of FIS client banks and credit unions to securely share banking data. The solution will integrate with Akoya, Envestnet, Yodlee, MX and Plaid.

The Reading Nook

Daaaammmmmnnnn Matt Brown, back at it again with the insightful fintech pieces. Check out his latest - Payfac in 1,000 words.

Francisco Javier Arceo wrote a great piece in Chaos Engineering on Affinity Marketing and the Latino American Fintech Opportunity. The piece, and his thoughts, are informed by his previous efforts to start a personal financial management tool for Latinos.

Techcrunch dropped its thoughts on which fintech startups could go public in 2024… will be exciting to see which come true!

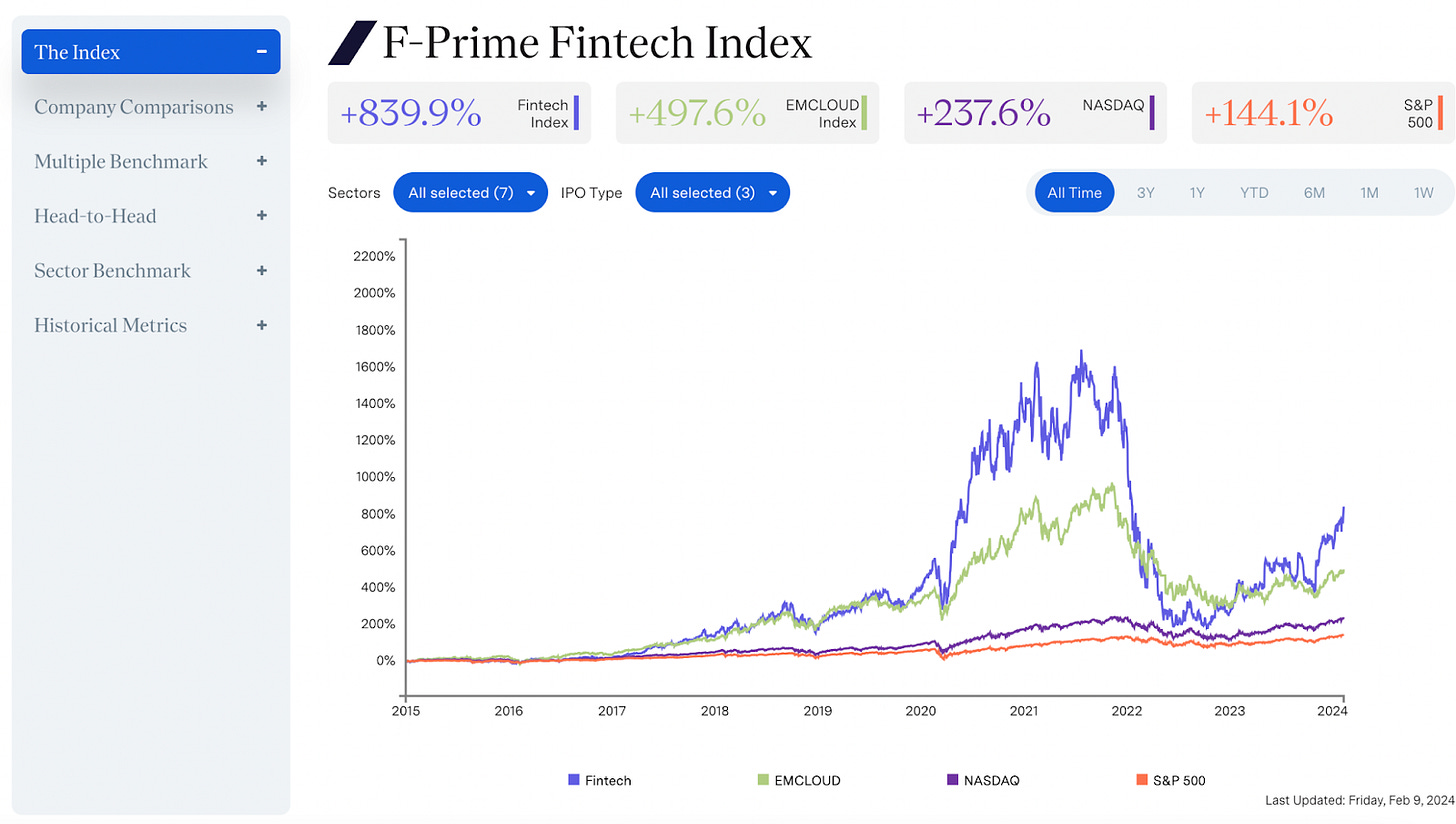

F-Prime Capital dropped its 2024 State of Fintech Report. Check it out!

Selected fundings

Finally, the fintech that helps SMBs to automate their accounting and financial processes, raised $10 million in new funding.

SUMA Wealth, which aims to help young U.S. Latinos build wealth, raised $2.2 million in new funding.

B2B identity startup Mesh raised $5.7 million in a seed funding round led by Greycroft.