Fintech Update, 12/21 - 1/3

Hi! It’s Monday January 4, 2021.

Happy New Year! We hope that all of our readers had a chance to enjoy some downtime over the holidays. We can’t wait for another year of being in your inbox - thanks for letting us be here!

Leading Off

The SEC filed a lawsuit against cryptocurrency platform Ripple, its CEO, and its chairman, for illegally selling unregistered securities worth $1.3 billion. // In other news, the People’s Bank of China laid out a five-point compliance agenda for Ant, Goldman Sachs began testing new wealth management services to be rolled out to the public via Marcus, the OCC approved LendingClub’s acquisition of RadiusBank, and Current received the second round of government stimulus payments, less than three hours after the funds were issued. // All this + more below!

Heavy Hitters

SEC charges Ripple with unregistered securities offering. The Securities and Exchange Commission (SEC) brought a complaint against the crypto payments platform, chairman Christian Larsen, and CEO Brad Garlinghouse for raising over $1.3 billion via an alleged “unregistered, ongoing digital asset securities offering” [full text]. The SEC’s action gets to the core of the ongoing debate about cryptocurrencies like Ripple’s XRP; namely, whether they are more properly considered currencies or securities. The SEC, applying its famous Howey Test and case law, argues that XRP behaves like equity, pointing to Ripple’s sale of the token to raise funds from U.S. and global investors, “structuring and promoting the XRP sales . . . to finance the company's business.” Ripple maintains that the SEC “is wrong on the facts, the law and the equities . . . [and] amounts to an unprecedented and ill-conceived expansion of the Howey test and the SEC’s enforcement authority against digital assets." Garlinghouse has already stated that Ripple may relocate from the U.S. to avoid regulatory challenges like this, and the outcome of the SEC’s action could encourage Ripple and other firms to move to friendlier jurisdictions. Regardless, it’s almost certain to chill the environment for crypto companies operating in the U.S. Stay tuned.

Quick Takes

China ups its anti-Ant ante. After stomping on Ant Group’s planned mega-IPO in early December, China’s central bank and financial regulators announced a “five-point compliance agenda” to assist the company with resolving its alleged violations, the latest twist in a recent spate of moves against Jack Ma’s empire (the government is also investigating his original company, Alibaba, for alleged monopolistic behavior). Ant said it has now created an internal “rectification workforce” to meet its compliance requirements.

Goldman Sachs to roll out wealth management services for the public. Goldman has begun testing an automated wealth management / investment service that would be offered through Marcus. The service, which will feature Goldman’s smart-beta ETFs and asset allocation models designed by its private wealth management investment group, will be rolled out next year.

OCC approves LendingClub’s acquisition of Radius Bank. The OCC approved LendingClub’s acquisition of Radius Bank, which was initially announced in February 2020. However, LendingClub will still need approval from the Federal Reserve on the company's pending application to become a bank holding company.

UK ad regulator takes a swipe at Klarna. The British Advertising Standards Authority banned a Klarna-sponsored Instagram influencer campaign, claiming it encouraged customers to take on debt through the firm “to cheer themselves up during the pandemic.” The regulator objected to campaigns suggesting followers “splurge” on skincare products and clothing to “boost their mood” amid Covid.

Meanwhile, Klarna expands to new POS devices. The “buy now, pay later” firm expanded its footprint to Verifone point-of-sale (POS) devices, allowing consumers to choose Klarna financing at checkouts in the U.S. and Europe as part of the Verifone Cloud Services platform. The firm will provide three POS payment options: “pay in four installments, pay in 30 days, and financing.”

Current becomes the first fintech to receive second round of stimulus. The challenger bank said it was the first fintech in the country to receive the second round of government stimulus payments, less than three hours after the Treasury announced the funds were being issued on December 29th.

Italy to explore DLT and digital euro. At the “urging” of the European Central Bank, the Italian Banking Association plans to conduct a “technical feasibility study on the use of distributed ledger technology for a future digital euro.” The study aims to explore use cases for the proposed digital euro and “is open to all interested banks.”

Robinhood faces class-action lawsuit for selling stock orders. The suit alleges that the trading app didn’t disclose its heavy reliance on payment for order flow, and that principal market makers passed such costs along to its clients. The suit follows Robinhood’s recent $65M settlement with the SEC.

Pop Flies

FYI, there are now 265 neobanks around the world . . . and more on the way!

The founders of Pipe, a financing platform for SaaS companies, explain why they moved their company from SF to Miami during the pandemic.

Goldman Sachs, ClearSky Security, and NightDragon jointly acquired White Ops, a global leader in solutions for enterprises and internet platforms seeking protection from digital fraud and abuse.

UK challenger bank Revolut and Belgian insurtech startup Qover partnered to provide an embedded insurance solution to Revolut’s subscribed account holders.

The Financial Times looked at how the pandemic has pushed American consumers to digital banking— by cutting in-person transactions, banks have been able to trim costs and branches.

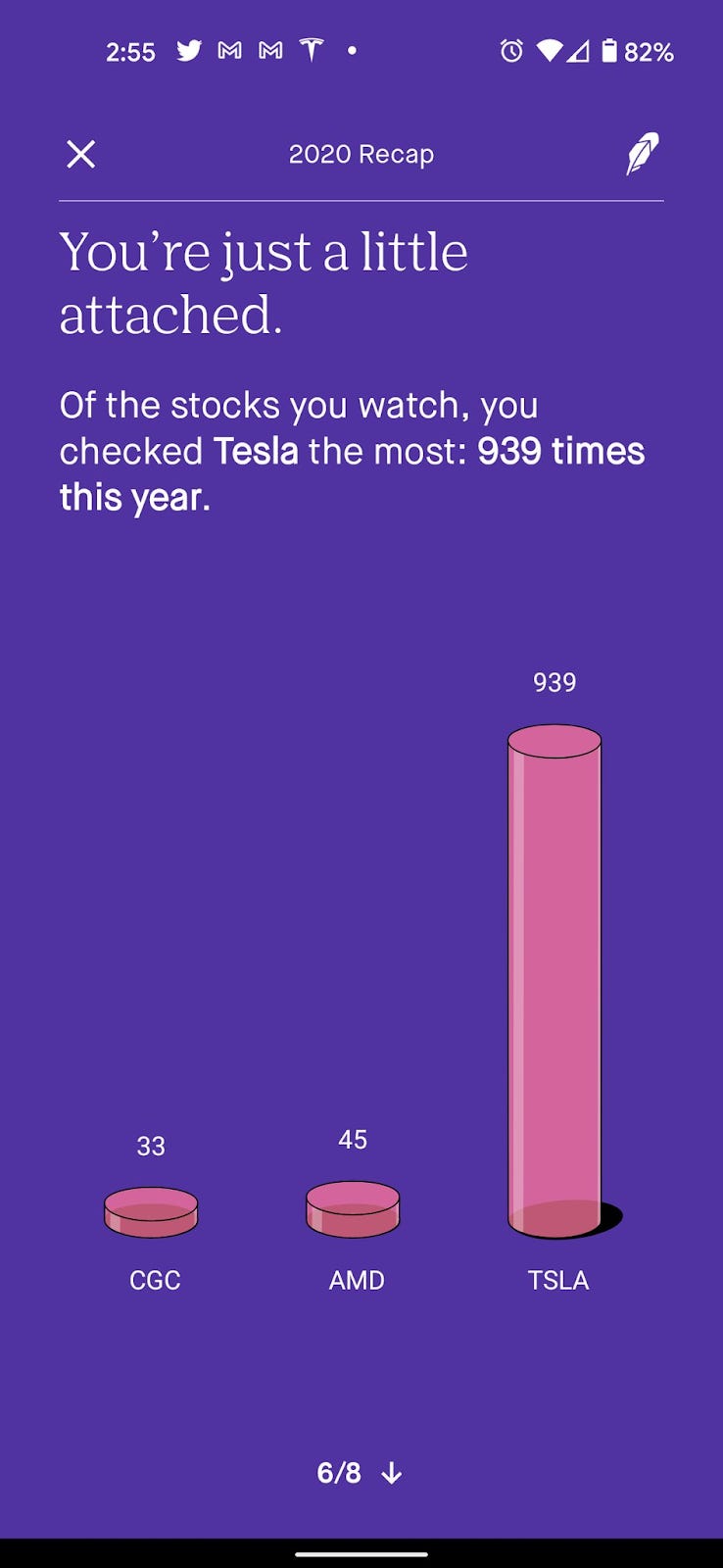

If you thought your ‘Spotify Wrapped’ was uncomfortable, check out Robinhood’s year in review feature.

Fundings!

Checkout platform Bolt raised $75 million in Series C funding.

SMB financing provider Liberis raised £70 million in debt and venture debt financing.

Crypto payments firm Flexa raised $20M through the sale of its ‘AMP’ private token.